Mortgage interest tax deduction 2023 calculator

2023 Tax Return and Refund Estimator for 2024 The 2023 Calculator on this page is currently based on the latest IRS data. Use this calculator to see how.

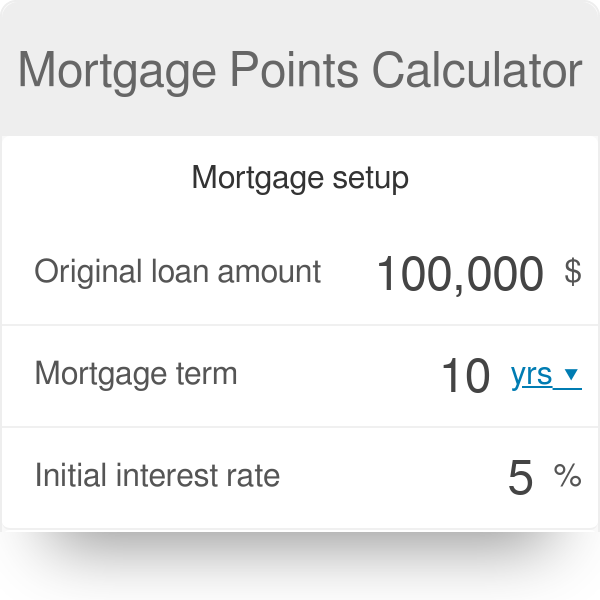

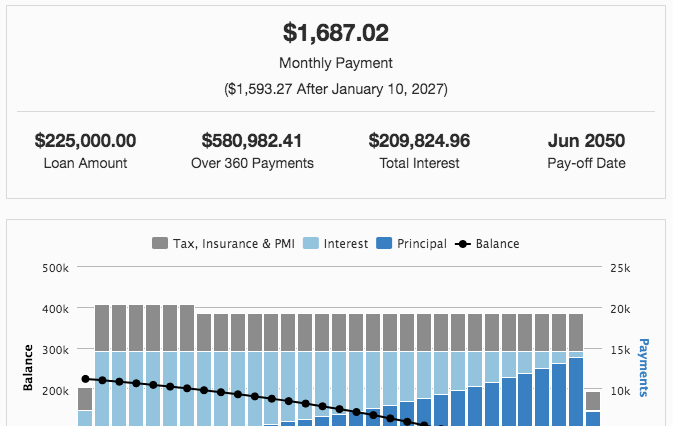

Mortgage Points Calculator

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

. If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300. Net Income 200000 80000 120000. Homeowners who bought houses after Dec.

Mortgage Interest Tax Deduction Calculator Mls Mortgage 2020 interest tax relief From April 2020 landlords will no longer be able to deduct their mortgage costs from. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Since April 2020 youve no longer been able to.

Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. As the IRS releases 2023 tax guidance we will update this tool. However higher limitations 1 million 500000 if married filing.

For a landlord charging 1000 per month rental income and with mortgage interest payments of 650 per month it worked like this. So it is seen that without the. Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal.

The mortgage interest deduction allows homeowners who itemize their deductions on their tax forms to deduct their interest on qualified personal residence debt. A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction. It is mainly intended for residents of the US.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. They earn rental income of 12000 for the year They pay. The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 1 million of mortgage debt.

The Tax charged in situation 1 is 60000 and Tax charged in situation 2 is 80000. But after 2018 these same. And is based on the tax brackets of 2021 and.

Use this calculator to see how much you.

Extra Payment Mortgage Calculator For Excel

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

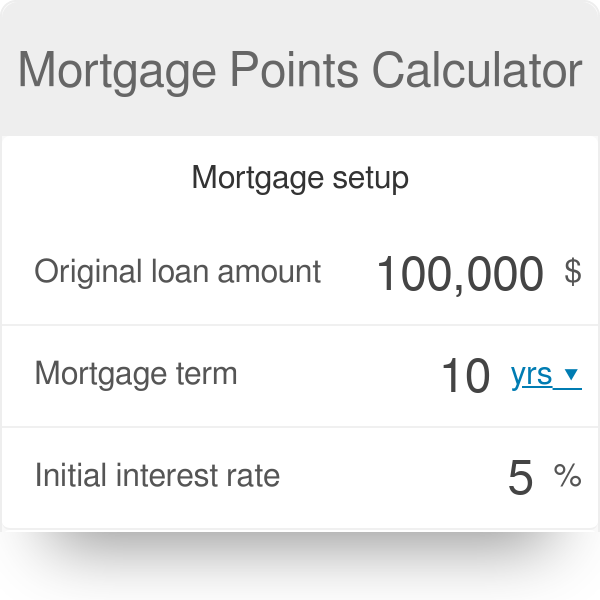

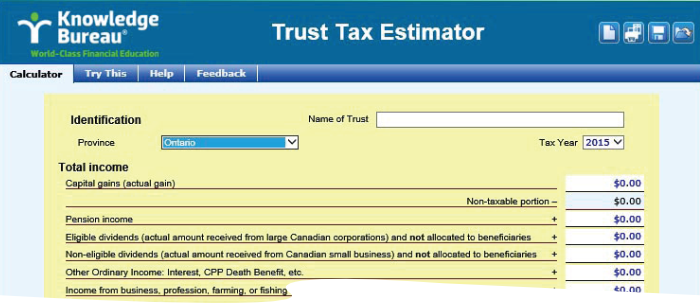

Knowledge Bureau World Class Financial Education

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

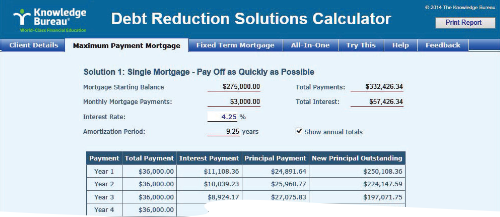

Mortgage Calculator

Mortgage Interest Calculator Principal And Interest Wowa Ca

Interest Only Calculator

Mortgage Interest Calculator Outlet 57 Off Www Wtashows Com

Inflation Vs Interest Mortgage Repayment Strategies Link To Calculator Spreadsheet R Personalfinance

2021 2022 Income Tax Calculator Canada Wowa Ca

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Home Ownership Expense Calculator What Can You Afford

Interest Only Calculator

Mortgage Amortization Calculator Crown Org

Mortgage Interest Calculator Outlet 57 Off Www Wtashows Com

Knowledge Bureau World Class Financial Education

Mortgage Down Payment Calculator Ratehub Ca

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator